Enterprises Apply Compliance & Regulatory Support to Unlock Operational Gains

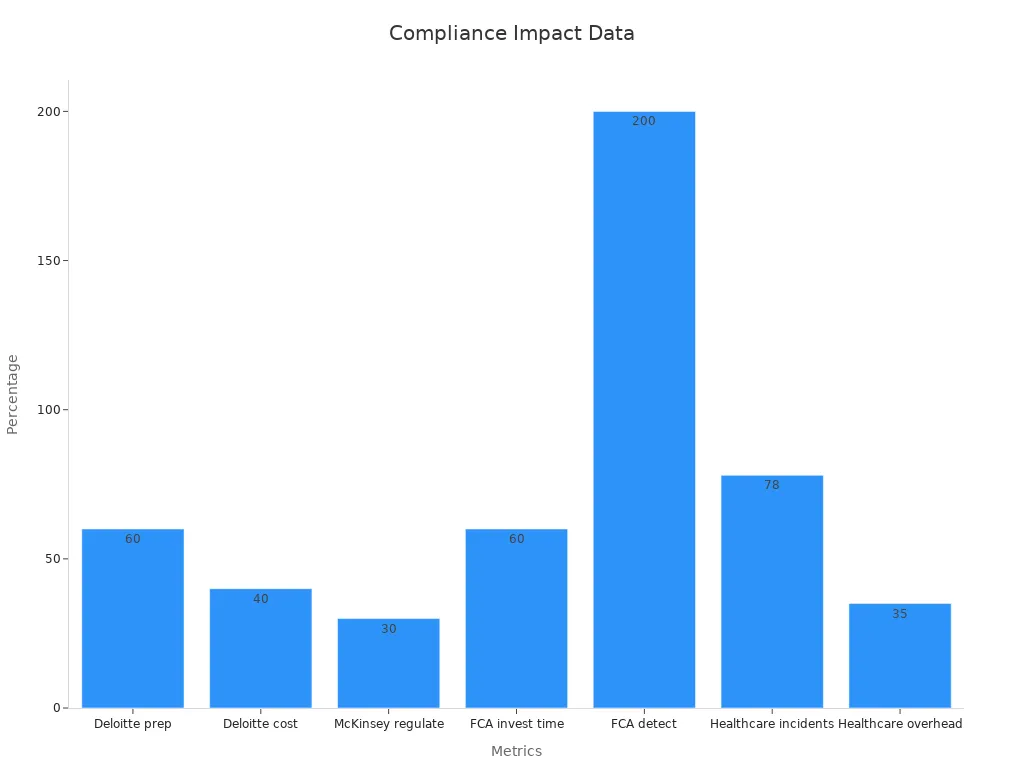

Enterprises Apply Compliance to achieve greater efficiency, reduce risk, and boost agility across operations. Robust compliance programs help organizations cut audit preparation time by 60% and lower audit costs by 40%, according to Deloitte. A proactive approach, supported by advanced analytics and automation, increases detection rates and reduces false positives in investigations. The following chart highlights these measurable gains:

Standardized processes and real-time monitoring enable smarter decisions, more transparency, and faster adaptation to regulatory changes.

Key Takeaways

Enterprises boost efficiency and reduce risks by embedding compliance into daily operations using automation and real-time monitoring.

Automation cuts manual work, speeds up processes, and improves accuracy, saving time and lowering costs across industries.

Strong compliance programs protect data, reduce breaches, and build trust with customers and regulators.

Continuous monitoring and regular training help organizations stay agile, quickly adapt to changes, and maintain audit readiness.

Leaders who measure compliance success and foster a culture of accountability unlock lasting operational improvements and competitive advantage.

Enterprises Apply Compliance for Operational Excellence

Driving Efficiency Through Compliance

Enterprises Apply Compliance to streamline operations and boost productivity. Many organizations use technology solutions like Manufacturing Execution Systems (MES) to automate compliance tasks, improve quality management, and gain real-time visibility into their processes. These systems help manufacturers meet regulations such as FSMA Section 204(d) by enhancing traceability and recordkeeping. This approach prevents disruptions and optimizes daily operations. Across industries, companies embed compliance frameworks into their workflows to drive collaboration, support ethical practices, and enable continuous improvement.

Automation of data tracking and report generation reduces manual effort and errors.

Regular monitoring of compliance gaps allows teams to adapt quickly and improve processes.

Centralized compliance tools help organizations align compliance with business goals.

Research shows that robust data management frameworks using AI, blockchain, and big data analytics enhance compliance and operational performance. These technologies help organizations manage regulatory requirements, reduce risks, and improve efficiency.

Reducing Risk with Regulatory Support

Enterprises Apply Compliance to reduce risk and strengthen trust. In healthcare, compliance with HIPAA involves data encryption, access controls, and staff training to protect patient privacy. Banking and finance sectors use frameworks like AML and KYC, supported by AI-driven fraud detection, to increase transparency and reduce fraud. Retailers embed privacy controls to protect consumer data, while manufacturers focus on safety and environmental compliance.

The table below highlights quantitative outcomes from compliance interventions:

Case Study Context | Compliance Intervention | Quantitative Outcomes |

|---|---|---|

Healthcare Corporate Governance | Cloud-based compliance software, digital training | 40% reduction in audit prep time, fewer documentation errors, improved staff awareness |

Technology Firm Data Protection | AI-driven monitoring, encryption, security reviews | 65% faster incident response, 50% fewer unauthorized access incidents, higher customer confidence |

Enhancing Agility and Competitive Advantage

Compliance initiatives help organizations stay agile and competitive. ING reorganized staff into autonomous squads, reducing time-to-market by 30% and improving customer satisfaction. Philips Healthcare formed compliance teams that worked with agile squads, cutting development cycles by 40%. Effective data governance supports decision-making and keeps organizations flexible.

A recent survey found that 64.8% of executives invest heavily in data governance, recognizing its value beyond compliance. Mature governance enables seamless data integration, supports analytics, and ensures compliance, helping organizations scale and grow sustainably.

Key Operational Benefits of Compliance Initiatives

Process Automation and Streamlining

Organizations achieve significant gains by automating compliance processes. Automation tools reduce manual errors, speed up workflows, and improve delivery reliability. For example, a retail company shortened order processing time from two days to four hours by automating compliance checks. Process mining and automation tools help companies like Von Ardenne lower error rates, cut costs, and boost customer satisfaction. The following table highlights key metrics that show the impact of compliance automation:

Metric Category | Metric Name | Description and Relevance to Compliance Automation |

|---|---|---|

Process Effectiveness | Error Rate | Fewer failures or defects due to automated compliance checks |

Process Effectiveness | Customer Satisfaction | Higher satisfaction from faster, more reliable service |

Process Effectiveness | Delivery Reliability | Improved on-time delivery through automated monitoring |

Process Efficiency | Cost Reduction | Lower expenses from optimized, automated processes |

Process Efficiency | Resource Efficiency | Better use of resources through streamlined compliance workflows |

Automated compliance dashboards and alerts help teams respond quickly to issues, ensuring deadlines and standards are met.

Improved Data Management and Security

Enterprises Apply Compliance to strengthen data management and security. Mature compliance programs now use mapping controls across frameworks, which 62% of security leaders report as essential for handling multiple regulations. In 2023, 53% of compliance professionals described their programs as mature or optimizing, up from 38% in 2022. This growth shows progress in aligning policies and training with regulatory needs. Organizations with strong compliance measures report fewer data breaches and lower costs. Data breaches linked to non-compliance cost nearly $220,000 more on average. Privacy regulations also help reduce cyber risks, with 73% of leaders recognizing their effectiveness, up from 39% the previous year.

Proactive Risk Mitigation

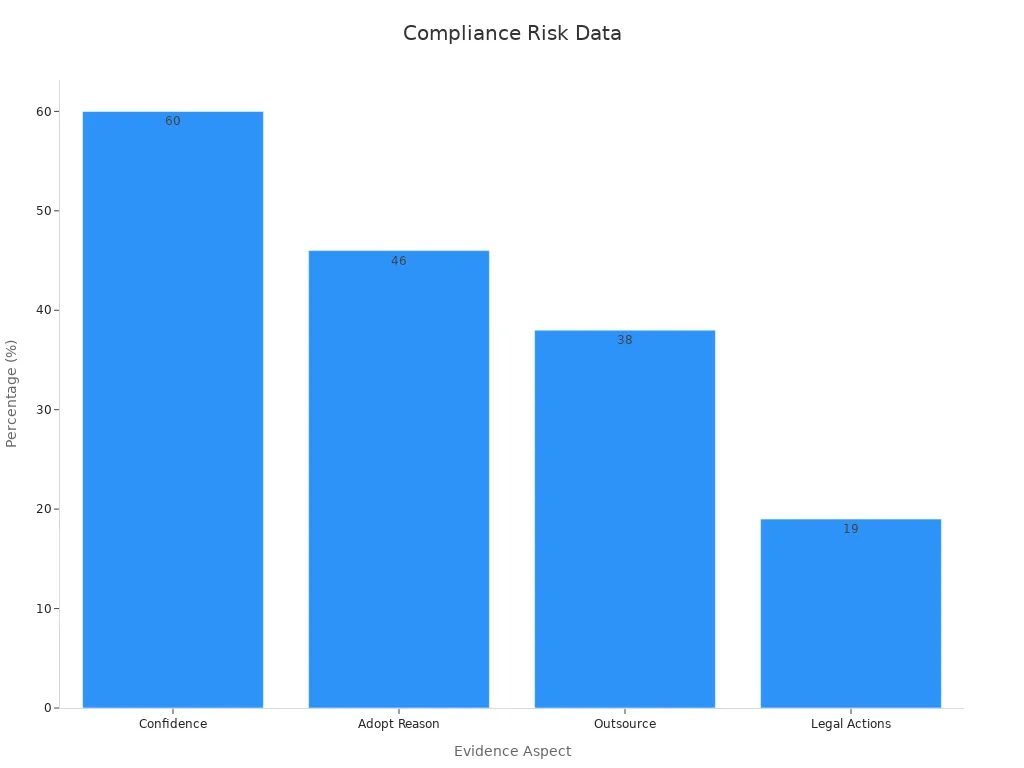

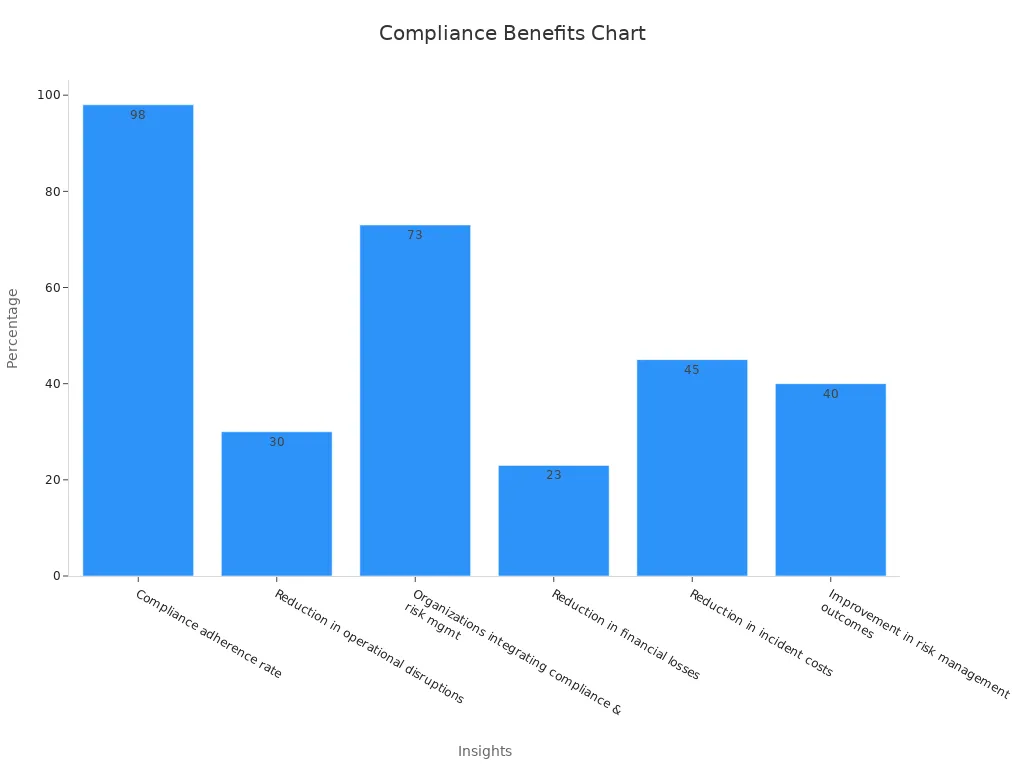

Compliance initiatives enable organizations to identify and address risks before they escalate. Automated risk assessments, regular training, and continuous monitoring support proactive risk management. The chart below illustrates how compliance reduces financial and operational risks:

A recent survey found that 60% of risk and compliance professionals feel confident in managing compliance risks. Automation plays a key role, with 46% adopting it mainly to reduce risk. Only 5% of organizations do not use automation in their compliance programs, showing widespread adoption. Enterprises Apply Compliance to lower regulatory fines, improve incident response times, and foster a culture of accountability.

Step-by-Step Guide: How Enterprises Apply Compliance Strategies

Defining Compliance Objectives and Scope

Organizations begin by setting clear compliance objectives that align with business goals and regulatory requirements. Leadership teams play a crucial role by managing compliance from the top down. They ensure all stakeholders understand the importance of compliance and the risks involved. This approach fosters management support and shared accountability.

To define the scope, teams create achievable and measurable goals. These goals link IT governance risks to specific security objectives. Enterprises often use both qualitative and quantitative research methods to collect and analyze data. This process helps monitor and improve compliance processes over time.

Tip: Use objective, automated measurements for compliance indicators. This practice streamlines audit testing and reduces subjective judgments.

A structured approach to defining objectives and scope includes:

Aligning leadership and stakeholders on compliance priorities.

Setting measurable goals that support both security and business needs.

Choosing research methods that fit the organization’s size and complexity.

Analyzing data using statistical quality improvement methods.

By following these steps, organizations create a focused and effective compliance program.

Assessing Gaps and Regulatory Risks

After defining objectives, organizations assess gaps and regulatory risks. Gap analysis compares the current state with the desired state. This process identifies discrepancies and highlights areas for improvement. Teams use gap analysis to provide an objective overview, helping stakeholders make informed decisions.

Risk assessments assign numerical values to risks, such as financial impact and probability. This method enables objective evaluation and prioritization. Organizations document these assessments to align with standards like ISO 27001, NIST Cybersecurity Framework, and HIPAA. Quantitative findings help prioritize security investments based on potential financial loss and likelihood.

Automated tools and platforms enhance the efficiency of risk assessments. These tools address resource constraints and support continuous improvement. Risk assessments also help organizations detect emerging risks and evaluate existing controls.

Gap analysis highlights compliance gaps and improvement areas.

Risk assessments predict potential outcomes and support risk reduction.

Automated platforms streamline the assessment process and improve accuracy.

Deploying Controls, Policies, and Training

Once gaps and risks are identified, organizations deploy controls, policies, and training programs. Teams define roles and responsibilities at the process-owner level. This step ensures clear control ownership and accountability.

Organizations agree on standard configurations and automated monitoring. Control tests are defined and accepted by process owners. Automated systems generate evidence of compliance and share it proactively with auditors.

Regular control tests help detect deviations and validate configurations. Teams schedule these tests frequently enough to ensure reliability. Metrics and remediation reports track progress and address issues before audits.

Note: Maintain situational awareness and update controls when information flow or the control environment changes.

A typical deployment process includes:

Defining and assigning control ownership.

Establishing automated monitoring and reporting.

Conducting regular control tests and sharing results.

Organizing remediation reports aligned with business units or IT services.

Enterprises Apply Compliance by integrating these steps into daily operations. This approach builds a strong compliance culture and supports ongoing improvement.

Automating Compliance Processes

Automation transforms compliance from a manual, time-consuming task into a streamlined, efficient process. Organizations use automation to collect evidence, manage policies, and monitor compliance activities. Automated systems create a single source of truth, which saves time and reduces errors. Teams no longer need to search through multiple systems or rely on spreadsheets.

Automated evidence collection centralizes data and speeds up audits.

Real-time alerts from continuous monitoring improve reliability.

Policy and personnel management automation reduces manual work.

Task management automation speeds up remediation and prevents duplicate efforts.

Cloud remediation automation shortens the time needed to achieve compliance.

Automation delivers over 75% time savings across the compliance lifecycle.

Organizations can handle multiple compliance frameworks at once, reducing resource strain.

Automation supports scalable risk management and third-party oversight.

A Senior Program Manager in Security Governance notes that automation helps teams run operations more efficiently. Insights dashboards and automated reporting reduce redundant work and optimize resources. Out-of-the-box compliance content and automated project management make compliance faster and easier. Automation also lowers compliance costs and boosts audit readiness. Organizations see faster remediation and reporting, which leads to better operational efficiency.

Automation in compliance not only saves time but also improves accuracy and audit readiness. Teams can focus on higher-value tasks instead of repetitive manual work.

Continuous Monitoring and Improvement

Continuous monitoring keeps organizations ready for audits and helps them adapt to new risks and regulations. Teams use policy management, risk management, and incident management tools to track compliance in real time. Regular reviews and updates to monitoring strategies help organizations stay ahead of cyber threats and regulatory changes.

Continuous monitoring includes automated compliance checks that run without manual input.

Real-time visibility allows teams to detect and fix non-compliance issues quickly.

Integrating monitoring into daily workflows ensures ongoing alignment with regulations.

Advanced tools like SIEM systems, configuration management, and cloud security solutions support comprehensive monitoring.

Specialized compliance teams and advanced software drive continuous improvement.

Regular internal audits help organizations adjust compliance processes as needed.

Strong internal and external support networks, including compliance champions, foster the sharing of new strategies.

Continuous monitoring supports audit readiness by keeping compliance status up to date.

The shift from periodic to continuous monitoring comes from new technology, regulatory demands, and the need for business continuity.

Continuous monitoring data includes automated checks and real-time insights into compliance status. This approach allows immediate remediation of issues and reduces the burden of traditional audit preparation. Embedding compliance into daily business processes and providing ongoing training creates a proactive compliance culture. Organizations benefit from better security, predictable costs, and seamless integration of compliance activities. Continuous monitoring ensures operational resilience and builds trust with stakeholders.

Continuous improvement in compliance is not a one-time effort. It requires ongoing attention, regular audits, and a commitment to adapt as risks and regulations evolve.

Real-World Impact: Compliance-Driven Operational Gains

Financial Services: Process Automation Success

Compliance-driven process automation has transformed financial services by improving efficiency, accuracy, and scalability. Automation minimizes human error in tasks like access provisioning and audit logging, ensuring consistent enforcement of policies. This approach reduces regulatory violations and frees up resources for higher-value activities, such as risk mitigation.

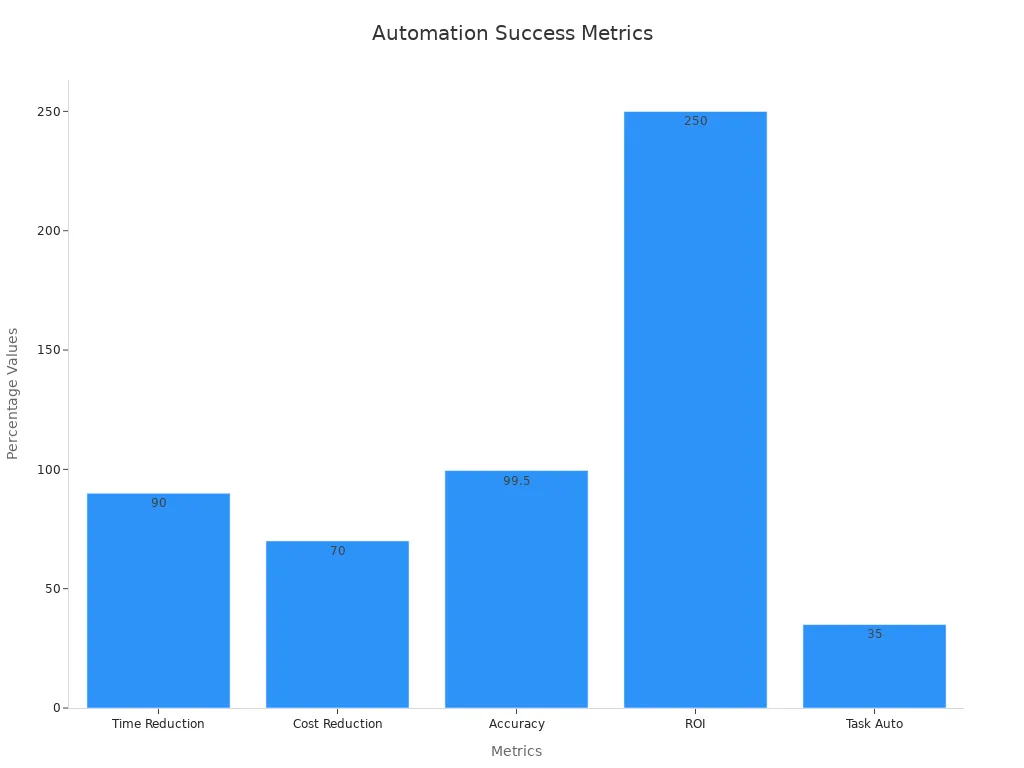

Key metrics highlight the success of automation in this sector:

Metric | Description | Impact on Compliance |

|---|---|---|

Processing Time Reduction | Compliance reporting reduced from 21 days to 2 days | Enables timely regulatory reporting |

Cost Reduction | Up to 70% reduction in processing costs | Frees resources for monitoring and risk management |

Accuracy Improvement | 99.5% accuracy in automated processes | Minimizes audit risks and compliance violations |

ROI | 250% ROI within two years | Demonstrates financial viability of automation |

Real-world examples further validate these gains. JPMorgan Chase saved $28 million annually and eliminated 360,000 manual hours through automation. Bank of America reduced mortgage processing time by 60%, enhancing compliance and customer satisfaction. These outcomes demonstrate how compliance initiatives drive operational excellence in financial services.

Healthcare: Data Security and Regulatory Alignment

In healthcare, compliance frameworks like HIPAA have significantly improved data security and regulatory alignment. Blockchain technology enhances compliance by encrypting patient data and enabling secure authorization through smart contracts. Case studies, such as MIT’s MedRec, show how blockchain applications strengthen data governance.

Statistical evidence underscores these improvements:

HIPAA outperforms ISO and GDPR in protection, trust, and security, with F-values of 63.54, 38.45, and 66.90, respectively.

Organizations with privileged access management solutions experience 47% fewer successful attacks.

Healthcare data breaches cost an average of $10.93 million per incident in 2023, emphasizing the financial impact of non-compliance.

Continuous monitoring and analytics allow healthcare organizations to adapt defenses proactively. This approach reduces incident response times by up to 61%, improving breach containment and regulatory adherence. These efforts not only enhance security but also build trust with patients and stakeholders.

Manufacturing: Supply Chain Risk Reduction

Manufacturing enterprises leverage compliance initiatives to mitigate supply chain risks and enhance operational resilience. Continuous supplier monitoring, real-time oversight, and AI-driven traceability systems ensure compliance with ethical and operational standards. These measures reduce risks of fraud, counterfeiting, and disruptions.

Key strategies include:

Comprehensive traceability systems to monitor supply chain activities across borders.

Embedding a culture of accountability through supplier training.

These efforts yield tangible benefits:

Improved supply chain resilience ensures quicker recovery from disruptions.

Cost savings arise from preventing penalties and expedited corrective actions.

Enhanced customer satisfaction results from reliable, timely deliveries.

For example, manufacturers adopting zero-waste production systems have maximized resource utilization and minimized environmental impact. Automotive companies using real-time supply chain analytics have reduced lead times and inventory costs, improving responsiveness. These examples highlight how compliance-driven strategies strengthen supply chain operations and foster competitive advantage.

Actionable Recommendations for Enterprise Leaders

Building a Culture of Compliance

Enterprise leaders set the tone for compliance by shaping workplace culture. They use employee surveys to measure knowledge and attitudes, benchmarking results against industry peers. These surveys use Likert scales and large datasets to show if the organization’s culture supports compliance. Anonymous feedback helps leaders find strengths and weaknesses in current programs. Regular surveys track progress and reveal trends over time.

Organizations with strong compliance cultures see less misconduct and lower risk. Yet, 87% of employees report weak ethical cultures, and only 30% say their companies have basic compliance programs. High-quality programs reduce risk and improve ethical behavior. Leaders who act on survey results can design better training and address gaps quickly.

Regular feedback and benchmarking help leaders build trust and show commitment to compliance.

Leveraging Technology and Expert Support

Modern compliance programs rely on technology and expert guidance. AI adoption for compliance monitoring rose from 20% to 38% in one year. Generative AI for fraud protection doubled in 2024. Automated audit tools now support 55% of organizations, up from 44% last year.

Many companies move to purpose-built platforms and cloud-based solutions. These tools improve third-party risk management and streamline compliance tasks. Still, only 31% of organizations use coordinated third-party risk strategies. Expert support remains vital, as 89% of professionals face unresolved issues in audits.

Leaders should combine advanced technology with expert advice to meet new regulations and manage risks.

AI and automation increase efficiency and accuracy.

Expert support addresses complex regulatory demands.

Measuring and Communicating Operational Value

Leaders must track and share the value of compliance efforts. Two key metrics stand out: the severity gap between predicted and actual risks, and the risk mitigation timeframe. The severity gap shows how well risk assessments match real outcomes. The mitigation timeframe measures how quickly teams address risks.

Other important metrics include:

Metric | Measurement | Value |

|---|---|---|

% completed | Shows readiness | |

Knowledge retention | % retained | Measures training impact |

SOP adherence | % compliance | Reduces risk |

Audit pass rate | % passed | Reflects control strength |

Defect reduction | % decrease | Improves quality |

Clear metrics help leaders allocate resources, redesign processes, and prove compliance value to stakeholders. Enterprises Apply Compliance to achieve these measurable gains and support business growth.

Enterprises Apply Compliance to achieve operational excellence and unlock measurable business value. Integrating compliance into core strategy leads to higher efficiency, fewer disruptions, and stronger risk management. Research shows that 73% of organizations see improved governance and 45% lower incident costs with integrated programs.

Metric / Insight | Statistical Value | Impact Description |

|---|---|---|

Compliance adherence rate | 98% | Demonstrates effective integration |

Reduction in incident costs | 45% | Lowers operational risk and losses |

Improved risk management | 40% | Better forecasting and control |

Leaders who view compliance as a strategic driver position their organizations for sustainable growth and resilience.

FAQ

What is compliance in an enterprise context?

Compliance means following laws, regulations, and company policies. Enterprises use compliance programs to make sure employees and systems meet these rules. This helps protect the business and builds trust with customers.

How does automation improve compliance?

Automation handles repetitive compliance tasks. It collects data, checks for errors, and sends alerts. Teams save time and reduce mistakes. Automation also helps companies prepare for audits faster.

Why is continuous monitoring important?

Continuous monitoring tracks compliance in real time. It helps teams spot problems early. Quick action prevents bigger issues and keeps the company ready for audits.

What are the risks of ignoring compliance?

Ignoring compliance can lead to fines, legal trouble, and damaged reputation. Companies may lose customers or face business disruptions. Strong compliance programs help avoid these risks.

How can leaders measure compliance success?

Leaders use metrics like audit pass rates, training completion, and incident response times. These numbers show if compliance programs work. Clear results help leaders improve processes and show value to stakeholders.

See Also

Conquering Challenges In Modern Enterprise Data Management

Why Companies Should Adopt AI Observability Solutions

Top Guidelines For Ethical AI Governance And Compliance

Smart Data Solutions Powering AI-Focused Businesses Today

Strategic Methods For Effective Data Migration And Deployment